The Protocol allows market participants to amend the terms of their legacy derivatives contracts to include these new Cessation Events Pre-Cessation Events and fallbacks. OTC derivatives are mainly used for hedging purposes.

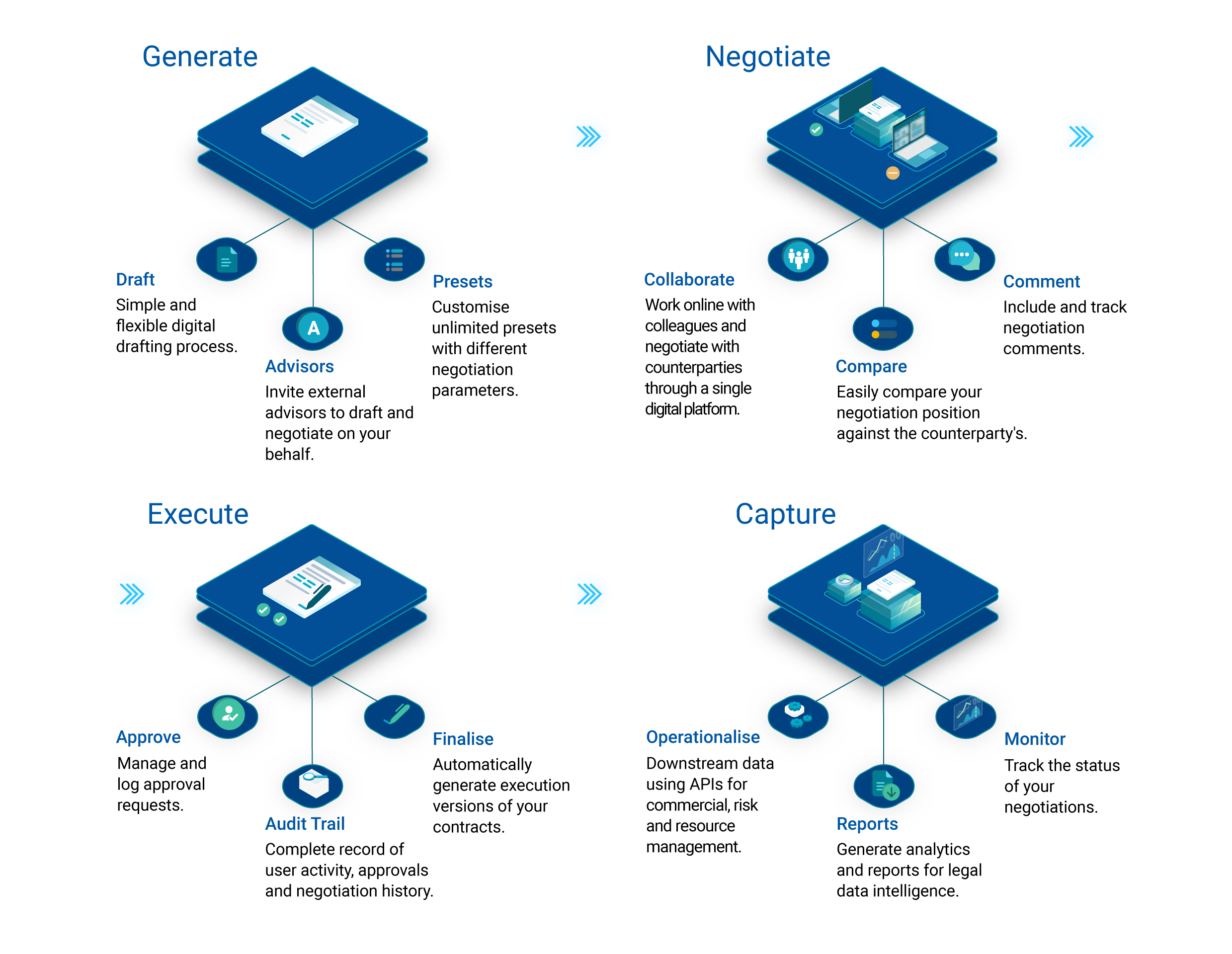

Isda Create Infohub International Swaps And Derivatives Association

What is base currency in CSA.

)

How isda protocols work. Base Currency The currency into which risk exposure and collateral is. A party that adheres to the Protocol agrees to amend. ISDA does however reserve the right to designate a cut-off date by giving 30 days notice on this site.

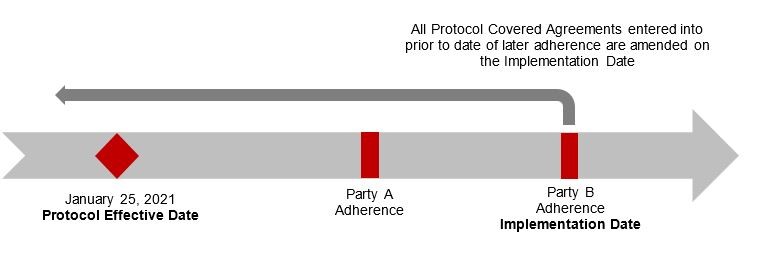

Where two or more parties have adhered to the protocol their agreements are deemed to be amended by the provisions of the protocol. Taking GBP-LIBOR-BBA as an example the definition is redefined either via the protocol. This is based on the principle that a party may agree with one or more other parties that certain terms and provisions will apply to their respective relationships.

The ISDA Master Agreement is an internationally agreed document published by the International Swaps and Derivatives Association Inc. To facilitate market compliance with these rules the International Swaps and Derivatives Association ISDA has been working on. Read more ISDA IllegalityForce Majeure Protocol Adhere to this Protocol View Adhering Parties ISDA IllegalityForce Majeure Protocol Text will open in a new tab or window Form of Adherence Letter will open in a new tab or window.

It is one of four parts of a standard contract or master agreement developed by the International Swaps and Derivatives Association ISDA. In order to facilitate implementation of Dodd. How does a CSA work ISDA.

Log in required to view protocol management content below. The ISDA IllegalityForce Majeure Protocol the Protocol offers market participants an efficient way to amend. Converted to calculate if a collateral call needs to be made.

ISDA protocols and LIBOR definition amendment emerged on Friday and are all on the ISDA website. An ISDA protocol is a multilateral contractual amendment mechanism that allows for various standardized amendments to be deemed to be made to the relevant agreements of any two adhering parties. Adherence is public and the names of adhering entities are published on the.

Check your document status here. The Protocol was launched by ISDA on 23 October 2020 and has an effective date of 25 January 2021. The protocol opens for signing on 23 October and the effective date will be 25 January 2021.

Security-based swaps documentation The ISDA 2021 SBS Top-Up Protocol. There is no cut-off date to this Protocol. In an individual capacity a market participant can adhere to the Protocol by executing and submitting a form adherence letter to ISDA.

The supplement will amend ISDAs standard definitions for interest rate derivatives to. Parties will pay a one-time fee of 500 to ISDA to adhere to the Protocol. The Fallbacks Protocol similar to other ISDA protocols that came before it is a means for users of derivatives to amend agreements covered by the protocol across all its counterparties.

The ISDA August 2012 D-F Protocol the DF Protocol is part of ISDAs Dodd-Frank Documentation Initiative aimed at assisting the industry in implementing and complying with the regulatory requirements imposed under Title VII of the DoddFrank Wall Street Reform and Consumer Protection Act Dodd-Frank. If two parties to an in-scope agreement both adhere to the Protocol prior to the effective date then their in-scope agreements will be amended by the Protocol with effect from 25 January 2021. The Protocol allows market participants to amend the terms of their legacy derivatives contracts to include these new Cessation Events Pre-Cessation Events and fallbacks.

The ISDA Jurisdictional Modular Protocol is intended to be a mechanism for market participants to comply with Stay Regulations in different jurisdictions that require financial institutions to obtain the consent of their counterparties to be subject to stays on or overrides of certain termination rights under SRRs. Sign and upload Adherence Letter that was generated by ISDA. The ISDA 2020 IBOR Fallbacks Protocol this Protocol was created to enable parties to Protocol Covered Documents to amend the terms of each such Protocol Covered Document to i in respect of a Protocol Covered Document which incorporates or references a rate as defined in a Covered ISDA Definitions Booklet include in the terms of such Protocol.

October 23 2020. In the coming months we expect most firms to rally around the agreement but as weve noted youll still have work to do if you sign on to confirm that your interests and for issuers your clients. The Protocols were developed to help parties amend their ISDA trading relationships to comply with rules developed by the US Securities and Exchange Commission SEC which come into force on 1 November 2021 Covered Rules.

The purpose of the Protocol is to offer market participants an efficient way to address various issues that arise when certain documents published by ISDA before 2002 Pre-2002 Documents are used with a 2002 Master Agreement. The Protocol provides a mechanism for parties to bilaterally amend their existing derivatives transactions to incorporate ISDAs fallback terms providing for a clear transition from USD Libor to SOFR upon the occurrence of certain objective easily observable events avoiding the existing inadequate fallback mechanics. Unlike a standard amendment between two parties the Protocol as with other ISDA protocols is a multilateral and standardized approach.

ISDA which is used to provide certain legal and credit protection for parties who enter into over-the-counter or OTC derivatives transactions. How does the ISDA Jurisdictional Modular Protocol work. A note explaining the nature and purpose of ISDA protocols including information on how parties to an ISDA Master Agreement can adhere to them.

October 6 2021 marks the compliance date for several Securities and Exchange Commission SEC rules with respect to 1security-based swaps SBS. The Protocol is open to adherence by all entities regardless of ISDA membership or domicile. ISDA has today launched the IBOR Fallbacks Supplement and IBOR Fallbacks Protocol marking a major step in reducing the systemic impact of a key interbank offered rate IBOR becoming unavailable while market participants continue to have exposure to that rate.

The swiss jurisdictional module to the the isda resolution stay jurisdictional modular protocol enables entities subject to the swiss regulation to amend the terms of their covered agreements by obtaining from certain counterparties a contractual recognition of the application of stays on termination with respect to requirements of the swiss. The new ISDA amended LIBOR definitions and protocol work in broadly the same way. How do ISDA protocols work.

Submit required information to generate your Adherence Letter. It provides a safety valve to prevent the massive derivatives market from seizing up. Practical Law guide to ISDA protocols.

Already over 350 entities have signed-up. These issues arise because Pre-2002 Documents were not drafted with the 2002 Master Agreement in mind. The ISDA fallback protocol is a key step.

The note also highlights some of ISDAs most recent and significant protocols. The Covered Rules reflect the regulatory regime imposed on market participants by the SEC in relation to the trading of security based swaps and certain. The Protocol is open to ISDA members and non-members.

Latham Watkins Discusses Ibor Fallbacks Protocol And Supplement From Isda Cls Blue Sky Blog

Tidak ada komentar