If parties want to remove non- ISDA documents from the lists in the IBOR Fallbacks Protocol or add non- ISDA documents to those lists they will need to do so bilaterally. The Protocol applies to a much wider range of documents than the parties might expect and is typically the case for ISDA Protocols.

Isda Launched The Ibor Fallbacks Supplement And Ibor Fallbacks Protocol Deloitte Japan Financial Services Industry

What is the ISDA 2020 IBOR Fallbacks Protocol the IBOR Protocol.

What is the isda fallback protocol. A critical milestone in LIBOR 2 transition. The International Swaps and Derivatives Association Inc. In the coming months we expect most firms to rally around the agreement but as weve noted youll still have work to do if you sign on to confirm that your interests and for issuers your clients interests are protected.

The EONIA Collateral Protocol offers market participants an efficient way to amend the terms of certain ISDA collateral. October 23 2020. The International Swaps and Derivatives Association Inc.

What agreements will the usage of the new fallbacks. It also published a protocol to ensure legacy contracts can rely on these provisions. The IBOR Protocol enables market participants to incorporate the contractual fallback amendments set out in the Supplement into legacy non-cleared derivatives and certain non-derivatives transactions.

The IBOR Fallback Protocol the Protocol FAQs and the bilateral. The ISDA fallback protocol is one of these solutions reached through market consensus and the FCA is prepared to challenge firms that do not sign up. Parties could also agree to incorporate the new fallbacks by.

Market participants who adhere to the IBOR. Once they have signed up to the protocol firms will need to determine whether or not they would like to. The Supplement updates the rate options set out in the 2006 ISDA Definitions.

The Protocol and Supplement amend the definitions of certain rate options by providing fallbacks that would apply upon the permanent discontinuation of key interbank offered rates IBORs and the non-representativeness of LIBOR rates. The Protocol is a multilateral contractual amendment that amends existing contracts referencing IBORs to provide for corresponding fallbacks. Where can I find the fallback rates.

Expect increased pressure from the official sector to get all major market participants to adhere to the protocol and thus implement robust fallbacks for their. The ISDA 2020 IBOR Fallbacks Protocol this Protocol was created to enable parties to Protocol Covered Documents to amend the terms of each such Protocol Covered Document to i in respect of a Protocol Covered Document which incorporates or references a rate as defined in a Covered ISDA Definitions Booklet include in the terms of such Protocol. The ISDA IBOR Fallback Protocol2 that will also be published will enable market participants to choose to incorporate the new fallbacks into their legacy non-cleared derivatives trades with counterparties that also opt to adhere to the Protocol.

Understanding the ISDA IBOR Fallbacks Protocol and Supplement. The ISDA IBOR Fallbacks Protocol and Supplement 70 to the 2006 ISDA Definitions takes into account the. ISDA 2021 EONIA Collateral Agreement Fallbacks Protocol.

Once they have signed up to the protocol firms will need to determine whether or not they would like to. The Fallbacks Protocol similar to other ISDA protocols that came before it is a means for users of derivatives to amend agreements covered by the protocol across all its counterparties. It provides a safety valve to prevent the massive derivatives market from seizing up.

The ISDA IBOR Fallback Protocol and What it Means for You Alright we know youre wondering what the heck the IBOR Protocol is and why you should care. By adhering to the ISDA IBOR Fallbacks Protocol market participants agree that their legacy derivative contracts with other adherents will include the amended floating rate option for the relevant IBOR and will therefore include the fallback. ISDA documentation among adhering counterparties.

The ISDA 1 Fallback Protocol first anticipated back in the heady pre-COVID days in September last year will be published on 23 October 2020 and become effective on 25 January 2021. The supplement will amend ISDAs standard definitions for interest rate. Summary and Takeaways for the Market.

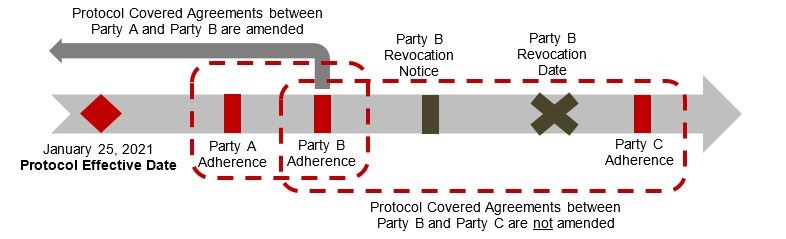

The ISDA fallback protocol is one of these solutions reached through market consensus and the FCA is prepared to challenge firms that do not sign up. ISDA is finally to launch the IBOR Fallbacks Supplement the Supplement to the 2006 ISDA Definitions and the ISDA 2020 IBOR Fallbacks Protocol the Protocol on Friday 23 October 2020. Where two parties adhere to the ISDA 2020 IBOR Fallbacks Protocol the Protocol it will amend legacy transactions between them so that upon the occurrence of a permanent cessation trigger or pre-cessation trigger for the 5 LIBOR rates of an IBOR a robust RFR-based fallback will apply.

ISDA has published its long-awaited 2020 IBOR Fallbacks Protocol the Protocol and related Amendments to the 2006 ISDA Definitions the Amendments. The launch of the Protocol and the Supplement representsa key landmark in the transition away from IBORs but is not a one-stop solution. ISDA has published the ISDA 2021 EONIA Collateral Agreements Fallbacks Protocol the EONIA Collateral Protocol.

They both have an effective date of 25 January 2021. Protocols provide an efficient way of implementing industry standard contractual changes to legacy trades with a large number of counterparties avoiding the need to bilaterally negotiate the same amendments with each party individually. ISDA Definitions that incorporate these fallback provisions in new contracts.

The Protocol and the Supplement which take effect on January 25 2021 provide robust fallback. The ISDA fallback protocol is a key step. Parties should consider the impact of the Protocol on other agreements that they have entered into that should not be covered by the Protocol.

Where two or more parties have adhered to the protocol their agreements are deemed to be amended by the provisions of the protocol. These documents together represent a significant step toward the bilateral modification of global derivatives documentation to address the. ISDAs fallbacks are a mean to ensure an RFR-linked replacement rate is agreed in contracts in the event of the discontinuation of an IBOR.

Some non- ISDA documents include references to key IBORs and as a result some non- ISDA documents will be within scope of the IBOR Fallbacks Protocol. ISDA has today launched the IBOR Fallbacks Supplement and IBOR Fallbacks Protocol marking a major step in reducing the systemic impact of a key interbank offered rate IBOR becoming unavailable while market participants continue to have exposure to that rate. Its a topic thats mind numbingly boring and confusing to even the savviest but its important for borrowers to understand to avoid potentially negative financial impacts on their floating rate loans swaps.

What do the ISDA fallbacks achieve.

Latham Watkins Discusses Ibor Fallbacks Protocol And Supplement From Isda Cls Blue Sky Blog

Tidak ada komentar